What makes Deribit useful for investors? Even if you don’t trade futures/options, the information Deribit generates can be used in a variety of ways to help improve your crypto portfolio and understand what’s happening to the crypto economy.

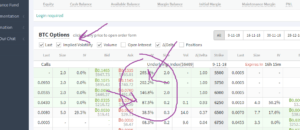

Deribit publishes implied volatility. Implied vol shows us what investors expect volatility to be, and is derived from the price of options. If you navigate to the options page of Deribit, you can see a list of checkboxes for displaying data in the option chain including the last price, volume, and open interest. Make sure the checkbox for “Implied Volatility” is checked, then view the implied vol numbers displayed beside each option (bids and offers).

Deribit also shows you the forward curve, which shows the difference between prices today and for the future. The forward curve is important to understanding market expectations, whether the curve is contango or backward. If you navigate to the futures trading page, you can see the current slope is slightly upward, meaning future prices are higher than spot prices. For example, the current spot price for bitcoin on Deribit is 6416, the December contract is 6458, and the March contract is 6468.

You can use Deribit to hedge your bitcoin risk, and you can speculate wildly if you like too. Deribit allows users up to 100x leverage on futures contracts, so if you really want to crank up your risk, and try to hit some home runs, Deribit is a good place to speculate. You can take a bullish or bearish position, by going long or short. Deribit users can also use options strategies to gain leverage such as buying out of the money puts and calls.