Deribit is a crypto-derivatives site featuring bitcoin futures and bitcoin options. Its a pretty cool site that offers some unique features unavailable to retail users in fiat economies. From a retail user’s perspective, being able to enter limit orders based on either the bitcoin value or the implied volatility value is a cool boost. When users enter an order based on an implied volatility number, the exchange automatically refreshes the order each 6 seconds based on the current variables. This way, a retail trader can enter an order that adjusts to the current market based on a fixed implied volatility number. This is something that most retail brokers in fiat economies do not offer. This type of functionality is obviously available to anyone accessing fiat exchanges using APIs: they simply need to write these crons into their own programs.

I’ve been a fan of trading tail risks ever since the days of InTrade when I wrote the tail risks on economic numbers each night for over a year and never had a losing trade. Its well documented today, with the popularity of behavioural economics over the past few decades, that the untrained human brain makes inaccurate estimates of long shots, and a small mis-estimate for a long shot can translate into a lot of missing/added value when the statistics don’t support such prices. For example, casinos are able to get a bigger house edge for long shot bets compared to even money bets. Consider the high house edge for most land based keno — which is pure long shots — compared to the low house edge for baccarat, the core game of which is close to even money.

Let’s apply the idea that we don’t estimate tail risks accurately to look for ways to profit on Deribit.

Deribit lists serial expirations on monthly and weekly bitcoin options. As time goes by, and expirations get closer, many of the “deep out of the money” strike prices lose liquidity because the minimum tick value is greater than the theoretical value of these tail risks. These deep out of the money strikes will go “no bid” once their theoretical value is less than the minimum tick. This is where the opportunity to profit can be found. I’ve noticed that what I’m assuming are manual order entry retail users with bids posted in the deep out of the money strikes where the theoretical price is lower than the single tick value. I assume that these users entered limit orders without expiration dates and didn’t cancel those orders as the particular strike went “no bid”. Another explanation is a user is short a particular deep out of the money strike and rather than waiting till expiration, the user is willing to pay an above market rate to close out the worthless position in order to free up margin or clean their position book. Whatever the reason, these bids are “pennies from heaven” for the savvy trader.

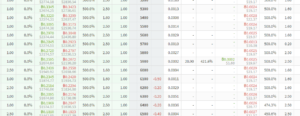

See the screen shot below that shows the bid on a worthless option at 0.0002 btc. The theoretical value of this option is actually worth less than the minimum tick of 0.0001 btc. A word of warning for those thinking of playing the tail risks: make them covered and remember the old saying about picking up pennies in front of a slow moving steam roller. Most of the time you’ll be able to take the penny, but there is a long-shot chance that you get called away or put in, so you need to either have the capital or enough liquidity to cover (either buying back or hedging). The nice thing about Deribit options is they are settled based on a futures contract that is liquid on the same exchange.