What is Qoinify?

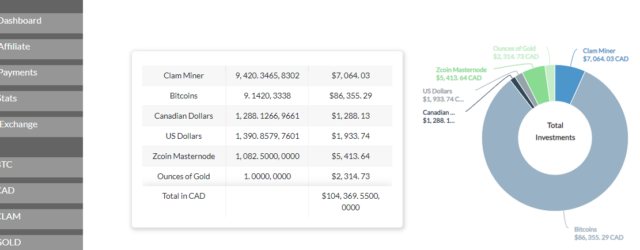

Qoinify is a open source crypto bank. Qoinify lets users exchange six currencies including Canadian dollars, US dollars, gold, bitcoins, clams, and zcoins. This post will describe the evolution of Qoinify and its current functionality. Click here to create a… Continue Reading